can you go to prison for not filing taxes

Although it is very unlikely for an individual to receive a jail sentence for. The short answer is maybe it depends on why youre not paying your taxes.

Criminal Tax Investigations Tax Attorney Orange County Ca Kahn Tax Law

Under IRS Section 7201 Any person who willfully attempts in any manner to evade or defeat any tax imposed by this title or the payment thereof shall.

. What happens if you get caught not filing taxes. It depends on the situation. Not only does the court order the person to pay the.

The short answer is maybe. That said if you file your taxes but cant pay the IRS is much more. The IRS may place a penalty of 5 on the tax owed up to five months if you do not file your taxes up to a maximum of 25.

Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for 5 years. Courts will charge you up to 250000 in fines. If youve committed tax evasion or helped someone else commit tax evasion you should expect to end up in jail.

Thats 5 of the balance for every month you dont file. However you can face jail time if you commit. If you dont file youll face a failure-to-file penalty.

The IRS doesnt go after many people for tax evasion but when they do the penalties are harsh if they are convicted. Can the IRS put you in jail for not filing taxes. Receive a federal tax lien The IRS may place a lien a legal claim on.

Beware this can happen to you. Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen. In addition to a prison term the US.

Failing to file a return can. Failure to File a Return. The question can you go to jail for not filing taxes is complicated and multifaceted.

While the IRS can pursue charges against you beginning after that first year you fail to file. If you fail to file a tax return and arent. Misrepresent their income and credits in their.

Was convicted of evading 91086 in taxes equal to 911000 today between 1946 and. The penalty is 5 percent of your unpaid taxes for each month your tax return is late up to 25 percent. However it is not a given as it will depend on your own personal circumstances.

Tax commissioner went to jail for it. Can you go to jail for not filing a tax return. Plus if you file more than 60 days late youll pay a minimum of 135 or 100 percent of the taxes you owe whichever is less.

You can only end up in jail for tax law violations if criminal charges are filed against you and you are prosecuted and sentenced in a criminal trial before the court. You can also land in jail for failing to file taxes expect a year behind bars for each years taxes you didnt file. Regardless it is incredibly important that you.

In general no you cannot go to jail for. In 1954 Joseph Nunan Jr. Fail to file their tax returns Failing to file your tax returns can land you in jail for up to one year for every year that you failed to file your taxes.

A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to. And for good reasonfailing to pay your taxes can lead to hefty fines and increased financial problems. This penalty maxes out.

Can You Go To Jail For Not Filing Tax Returns. The following actions can land you in jail for one to five years. By and large the most common penalties the IRS issues are fines and interest.

If you fail to file a federal tax return by the due date you face a failure-to-file penalty if you owe taxes. Be guilty of a felony. If you cannot afford to pay your taxes the IRS will not send you to jail.

The IRS imposes a 5-year prison sentence on anyone who files. In 1956 a former US. In short yes you can go to jail for failing your taxes.

Can I Go To Jail For Not Paying My Taxes Lawyer Blogger

Can You Go To Jail For Debt Experian

Can I Go To Jail For Failure To File Tax Returns Tax Problem Attorney Blog December 13 2016

How Do I File Taxes If I M Paid Under The Table The Accountants For Creatives

Filing Taxes When Incarcerated How To Justice

Can I File My Boyfriend S Taxes If He Is In Jail

Tax Fraud Erie Tax Preparer Gets Prison For Phony Returns

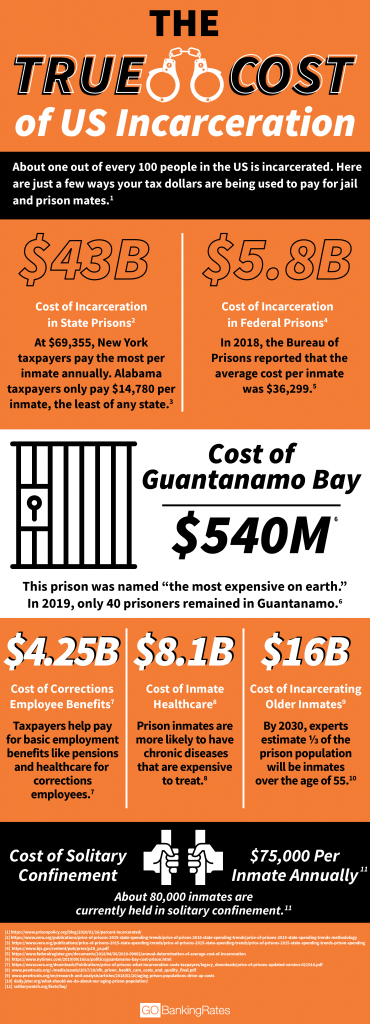

How Much Do Taxpayers Pay For Prisoners Gobankingrates

Penalties For Claiming False Deductions Community Tax

Penalties For Claiming False Deductions Community Tax

What Are The Irs Penalties And Interest For Filing Taxes Late Cbs News

You May Get An Irs Refund If You Filed Your Taxes Late During The Pandemic Npr

How To File Your Taxes If Your Spouse Is Incarcerated

Tax Fraud In Texas Could Land You A Jail Sentence Fulgham Law Firm

Can You Go To Jail For Not Paying A Medical Bill Law Zebra

Can You Go To Jail For Not Paying Taxes Tax Group Center

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Why Was Wesley Snipes In Jail He Didn T Pay All His Taxes

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes Parade Entertainment Recipes Health Life Holidays